Ask Our Experts: Strategic Budget Planning for New York City Condominiums & Cooperatives

Curious how FirstService Residential can help your building prepare its annual budget?

Towards the end of each calendar or fiscal year, condominium and cooperative boards begin preparing their annual operating budgets for the year ahead. In New York City, board members have observed a steady rise in utility costs, real estate taxes, and building labor. Now, more than ever, it’s crucial for boards to make strategic financial decisions to protect their properties from marketplace volatility and inflationary pressure.

To help guide our boards, FirstService Residential’s financial and management experts answered the most frequently asked questions about the current economic environment, potential impacts on building operating budget planning, reserve funds, and the role a property manager plays in the budget process for condos and co-ops.

You can also watch a live recorded discussion with our experts, who examine challenges and solutions for the building budget process in a volatile marketplace.

What is the difference between operating and capital expenses?

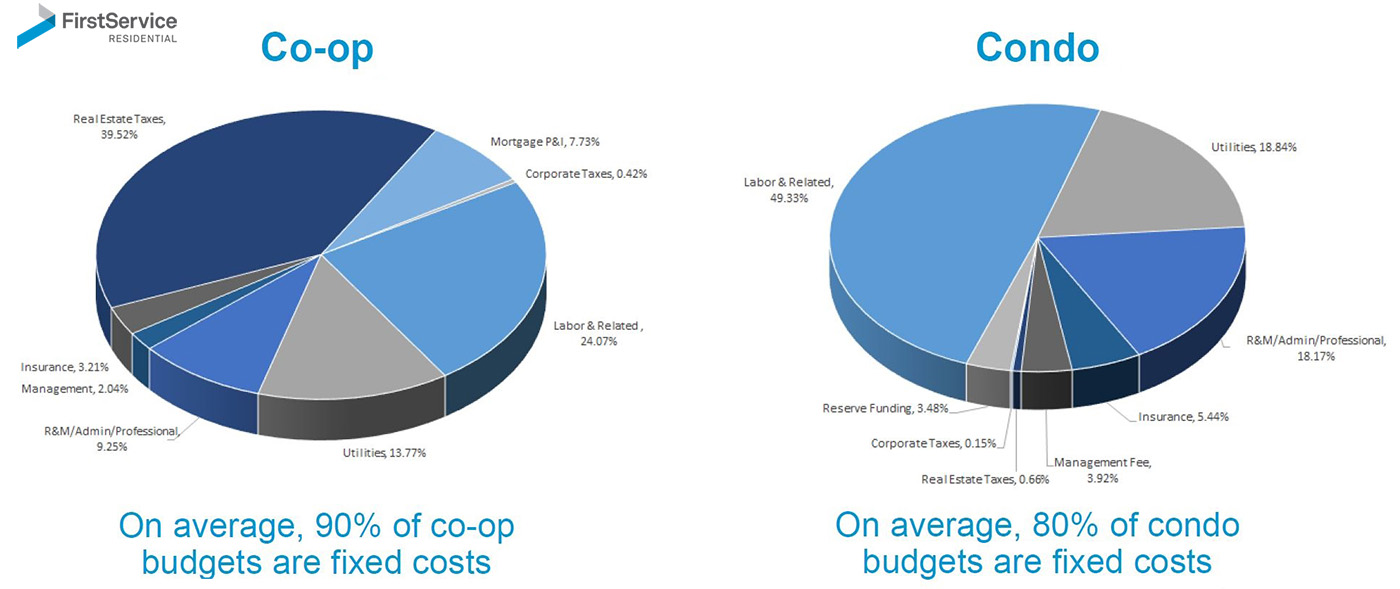

Building budgets are meant to prepare the board for typical and unforeseen expenses, as much as possible. These budgets comprise two specific types of expenses – operating and capital. On average fixed-operating costs comprise 80-90% of a building’s budget.Operating expenses comprise a building’s fixed costs and recurring future income:

- Anticipated income

- Maintenance fees or common charges, monthly parking and storage fees, commercial income, amenity memberships, etc.

- Mortgage and/or line of credit debt service

- Building repairs and maintenance

- Contractual expenses – Line items required by law (compliance) or contract

- Elevator maintenance, exterminator, water treatment, security systems, etc.

- Annual insurance premiums

- Property, general liability, directors and officers, crime and umbrella coverages, etc.

- Overhead – Miscellaneous items necessary to operate the building

- Office equipment, cleaning supplies, phone and internet service, postage, etc.

- Payroll & Real Estate Taxes

- Professional Services

- Accountants, attorneys, architects/engineers, and professional organizations

- Utilities

- Annual fees for electricity, oil, gas, and water

- Vendor Services

- Plumbing, HVAC, landscaping, snow removal, painting, pest control, snow removal, pool maintenance, laundry services, window cleaning, property management fees, etc.

Budgeted capital expenses comprise large improvement projects and upgrades that are already planned.

- Major building repairs & restoration projects

- Capital improvements

- Energy upgrades

In a recent guide, our experts assembled seven tips for buidling a better budget. Click here to get started.

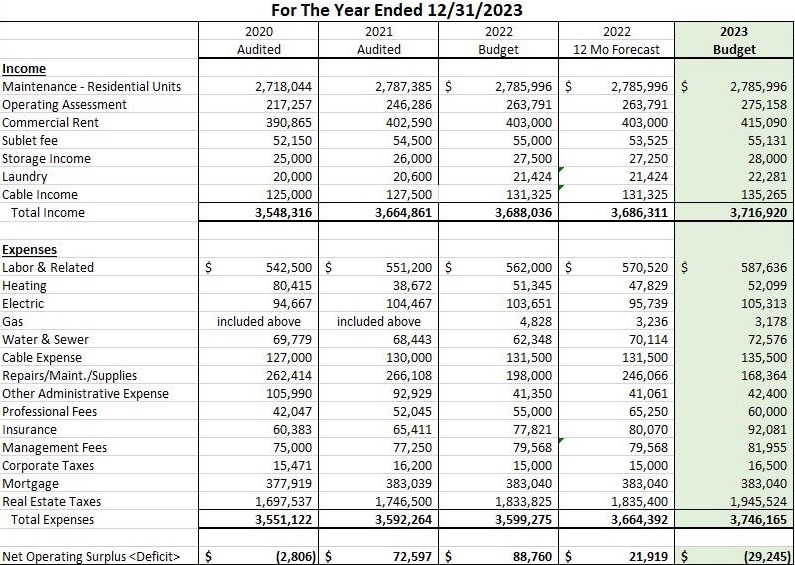

Snapshots of a typical operating budgets in New York City (click images to enlarge):

What to know about reserve funds.

Capital expenses can also include a reserve fund analysis. Your reserve fund is a budgetary component designed to pay for big ticket items including the replacement of building systems, remediation following a building disaster, or the construction of a new amenity space. Reserves are intended to grow over time through regular funding that comes from transfer fees and/or a percentage of common charges or maintenance fees.Consistently funding reserves over time will go a long way to protecting the fiscal health of your building.

Governing documents, typically in condominiums, may outline procedures that must be followed to contribute to the reserves and if funding requires approval from a majority of owners or shareholders.

How are property managers involved in the budget process?

The building budget process is the board’s ultimate fiduciary duty. At FirstService Residential, we provide our boards with a dedicated financial analyst who helps prepare the building budget. Working in partnership with the property manager, the analysts deliver comprehensive budget packages for our boards to review and approve.The board treasurer serves as the primary liaison between management and the board, and reviews all assumptions included in the budget to help fine-tune operating and capital expense line items. The treasurer is also present to help management deliver a budget that balances the fiscal needs of the building and the short-term desires of the board.

Some buildings create finance committees that include a mix of board members and owners. The committee weighs-in on line item expenses and facilitates communication with other unit owners and shareholders.

"There are currently a lot of inflationary pressures and as a result, boards are getting more hands-on in the budget process. While conservative budgeting is wise, it is most important to focus on being realistic, so that you are prepared for unknown surprises."

— Andrew Lester| President, FirstService Financial

At FirstService Residential, our experts analyze at least three years of historic budget and expense data, including vendor contracts, service agreements, insurance, and utilities. This process helps create a robust timeline of operating expenses and illuminates potential expenses that can be reduced or services that can replaced or modified.

How does FirstService Residential help boards save money on rising costs?

Insurance

To describe the current state of New York City’s liability insurance marketplace for condos and co-ops as “challenging” would be an understatement. For almost two years, underwriters and insurance professionals have documented the difficulties in obtaining competitive underwriting terms for general liability and umbrella insurance policies. Board members and managing agents across the city have experienced these tumultuous market conditions first-hand when attempting to obtain an insurance renewal.FS Insurance Brokers, our affiliated insurance brokerage, leverages the size of our management portfolio and historical claims and loss data to negotiate policies with lower annual premiums, better terms, and adequate coverage limits. Their team of experts has co-brokered over 3,200 placements for our clients, saving them over $5.5 million in annual insurance premiums.

Energy Utility Rates

In New York City, utility rates have exhibited drastic peaks and momentary dips, but are expected to rise significantly this winter. As part of our commitment to deliver value to our clients, FirstService Residential has helped our boards and building owners save millions of dollars in energy costs over the last decade, in part, through our Energy Aggregation Purchasing Program. Administered by our affiliate FirstService Energy, the program leverages the collective consumption of our management portfolio to secure competitive rates for natural gas and electricity.Today, the program ranks among one of the country’s largest gas and electric aggregation purchasing programs for multifamily residential buildings.

Cash Management, Lending & Investments

The Federal Reserve has slowly increased interest rates to help temper inflationary pressures. As a result, borrowing money is more expensive, and yields from saving or investing money are more lucrative.A rise in interest rates means that banks will offer greater returns on savings and money market accounts, and strong yields on CDs. Boards looking to refinance a mortgage or acquire a loan to finance a capital improvement or other large expenses are adversely affected by the rise in interest rates, because it now costs more to access those funds.

FirstService Financial, our in-house affiliate, proactively evaluates reserve portfolios to maximize interest income on deposit balances with FDIC-insurance coverage. With billions in deposits placed at commercial banks specializing in real estate, our team is able to negotiate favorable rates for our clients. By successfully reallocating funds to higher-yielding banks, we generated over $5 million in additional interest income for our clients in 2021. FirstService Financial also negotiates loans that yield lower interest rates and better terms than buildings can typically obtain on their own.