Monday March 14, 2022

The multifamily residential sector in New York City made significant strides in 2021 as borough economics continued to recover and transition into a post-pandemic paradigm. Investors, developers and prospective tenants were all active in the multifamily rental property market, leading to lower vacancies, increased housing construction and record levels of lending and borrowing. Mayor Eric Adams' 2022 administration has also set key housing goals which will directly influence the multifamily pipeline, from new construction projects to conversions of existing properties.Individual and institutional owners and investors wanting to take advantage of growing capital opportunities and higher demand will need to ensure their rental properties are attractive to lenders and renters, alike. Partnering with a top rental property management company is one way to achieve those goals.

FirstService Residential’s Multifamily Rental Division is the premier rental property management group in the nation. For 40 years, we have guided a broad range of institutional and family-owned portfolios and individual building owners with our tailored management approach to significantly increase revenue, maximize occupancy and retention and streamline operations. Click here to learn more about our tailored services.

Modern Renters Return to Market

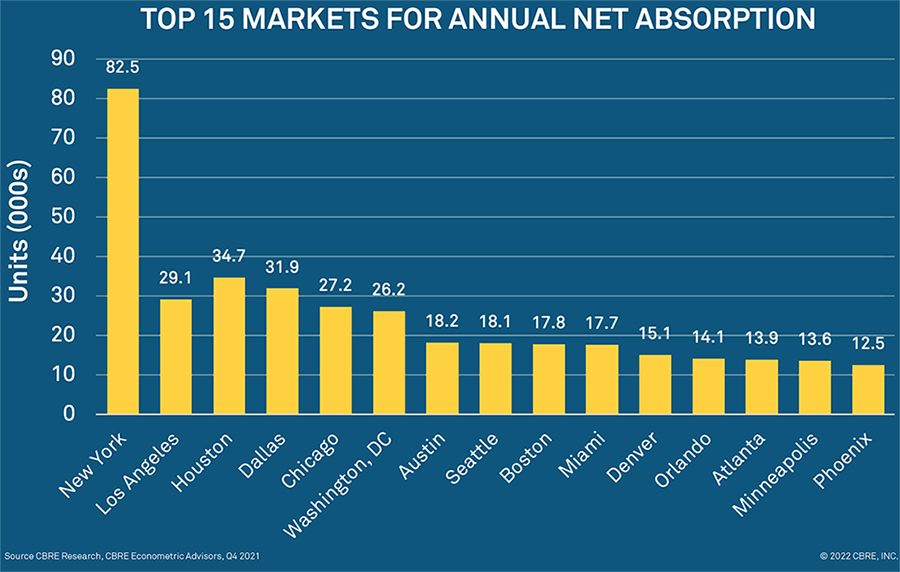

A new report on 2021 net absorption authored by CBRE also illustrates a strong rebound for the multifamily rental sector. According to the report, the national vacancy rate for multifamily rentals fell to a record-low 2.5%, while the nation’s average net effective rent increased by 13.4%. Fifteen of the nation’s largest metropolitan centers, including New York City, accounted for 62% of the total new absorption in 2021, representing roughly 382,600 units. New York City, alone, accounted for more than 13% of this figure.CBRE expects the ongoing economic recovery, expanding job market, wage growth, household formation and the reoccupation of workplaces will all positively support multifamily demand in 2022.

In New York City, the pandemic-caused vacancy trend has reversed and average rents now exceed their pre-pandemic levels. Research from Ariel Property Advisors, a leading commercial real estate advisory company, shows that renters are flocking back to the market at twice the rate observed in 2019. Multifamily transaction volume rose 42%, and rental prices are expected to continue an upward trend as new and returning renters drive up demand.

As of November 2021, median rent has increased to roughly $3,210 from $2,957 per month in November 2020.

Owners and investors will need to attract these renters and retain existing tenants to maintain these record-low vacancy rates and maximize revenue. With many tenants telecommuting on a part-time or full-time basis and spending more time at home, modern renters prefer professionally-managed, amenity-rich properties.

New Construction & Conversion on the Rise

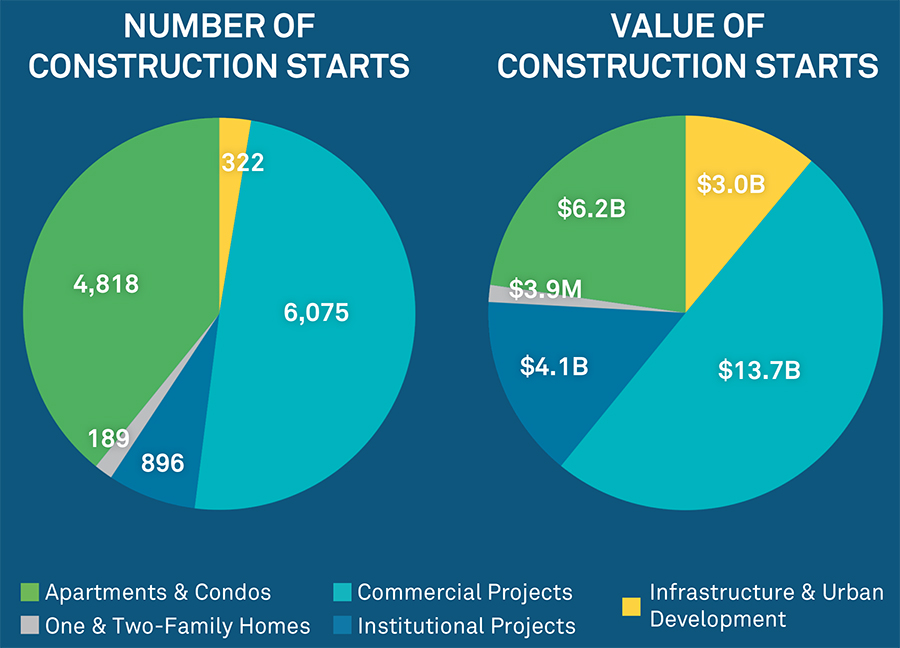

A recent report from the New York Building Congress indicates that Manhattan saw a significant spike in construction in 2021, with $7 billion in new projects started. An additional $29.5 billion worth of projects entered pre-design, design and bidding phases that year.“New construction deliveries of 81,000 units in Q4 brought the 2021 total to 274,500. With a pipeline of more than 400,000 units currently under construction, 2022 deliveries are expected to eclipse 2021.”

–National Figures, U.S. Multifamily | Q4 2021, CBRE

Investment & Lending Surges

According to the Mortgage Bankers Association, commercial and multifamily lending in 2021 surpassed record levels. In Q4, there was a 79% year-over-year increase and a 44% increase from the previous quarter. The outlook for 2022 remains positive, with multifamily lending expected to rise 5% from the prior year to $493 billion. Owners and investors will need to ensure that their properties are smoothly managed and can maximize revenue to remain attractive assets and make the most of potential lending opportunities.How can a leading property management company like FirstService Residential help?

FirstService Residential is the only property management company in New York with the ability to scale alongside the city’s ongoing construction boom. Drawing upon decades of experience, FirstService Residential offers extensive pre-development consulting and asset repositioning services for ground-up construction and commercial/hotel-to-residential conversion projects of all sizes.

Our experience managing condo/co-op and multifamily rental properties is invaluable during the construction and transition period. With our help, you can position your project for success when it enters the residential market.

As the leading multifamily management company in the New York City area, FirstService Residential manages more than 130 multifamily rental properties and over 500 condominium and cooperatives – a portfolio comprising roughly 90,000 individual units across the five boroughs. FirstService Residential is also the only full-service rental property management company that understands the dual needs of owners and renters and has the requisite experience and capabilities to fulfill them.

Our combination of national resources and local expertise empowers us to personalize our services and exceed the needs of residential portfolios no matter the size or location. Owners know that our innovative, reliable management approach helps protects asset value, provides best-in-class expertise, and optimizes building and staff performance.

Key reasons our clients trust our property management professionals with their multimillion-dollar assets:

- Innovative technology and solutions that maintain property values and increase tenant satisfaction

- Expert guidance on budgets and financial management

- Unmatched depth of resources and collective buying power to lower operating costs

- Hospitality-focused training programs for managers and building staff for consistent service

- Customized emergency planning and preparedness plans

- In-house leasing and marketing services for buildings and portfolios of all sizes

- In-house energy management, sustainability, and compliance experts

When you work with us, you’re working with proven innovators and the most established name in luxury rental property management.

---

FirstService Residential is committed to protecting the boards, owners and residents under our care. For decades we have partnered with the leading legal entities in the real estate sector to ensure the delivery of the most accurate and up-to-date guidance on complex regulatory issues.

If you’re a board or building owner in need of a property manager best equipped to support your property during these challenging times, contact FirstService Residential today.