FAQ: The Impacts of New York City’s Prevailing Wage Law on Condominium & Cooperative Properties

Boards must now pay building workers a prevailing wage or forfeit their eligibility for the Cooperative and Condominium Property Tax Abatement. Click below to watch our experts discuss this new amendment, impacts on operating budgets and maintenance fees, and the effects on individual unit owners and shareholders.

Beginning July 1, 2022, condominium and cooperative buildings in New York City must begin to pay building workers a prevailing wage or forfeit their eligibility for the Cooperative and Condominium Property Tax Abatement. The amendment was signed into law by Governor Kathy Hochul on September 6, 2021 and specifically applies to multifamily condominium and cooperative properties with an average assessed value of $60,000 or more.

Beginning July 1, 2022, condominium and cooperative buildings in New York City must begin to pay building workers a prevailing wage or forfeit their eligibility for the Cooperative and Condominium Property Tax Abatement. The amendment was signed into law by Governor Kathy Hochul on September 6, 2021 and specifically applies to multifamily condominium and cooperative properties with an average assessed value of $60,000 or more.If the building has less than 30 units, the average assessed value per unit must be more than $100,000 for the prevailing wage requirement to apply. For a condominium property, the average assessed value is the sum value of all units divided by the total number of units. For co-ops, a single average assessed value is assigned to the entire building.

What is prevailing wage in New York City and how is it determined?

Prevailing wage is the wage and benefit rate set annually by the New York City Comptroller each July. Prevailing wage rates for building service workers are intended to mirror wages, benefits and other terms of collective bargaining agreements between SEIU Local 32BJ and the Realty Advisory Board on Labor Relations (RAB). As a result, the existing 32BJ collective bargaining agreements are compliant with the state’s new prevailing wage law. Other unions, third-party staffing companies or contractors may not be paying a prevailing wage to affiliated workers.Our building already pays prevailing wage. How are we impacted?

Nothing will change for buildings with 32BJ unionized workers.What is a service employee and which employees must be paid a prevailing wage?

Under the new law, service employees are defined as any person who is regularly employed at a building and performs work in connection with care or maintenance of the property. In practical terms, this includes, doormen, porters, handymen, the superintendent and janitorial staff, among other typical building employees. The term “regularly employed” denotes employees who are regularly scheduled to work at least eight hours per week at the property. It does not matter which entity employs the service employee. This means that any regularly scheduled employee working on-site, whether directly employed by the co-op or condo, a third-party staffing company or contractors servicing the building (i.e., a landscaping company), must be paid a prevailing wage. If your building workers are employed by a third-party staffing agency, there is a chance that this employer is not paying their workers a prevailing wage nor a benefits package.How does the law impact workers employed by residents?

Workers employed by individual residents (i.e., nannies, dog walkers, housekeepers, etc.) are excluded from the prevailing wage requirement.How is FirstService Residential preparing its boards to address the new law?

If your building is not currently paying the building employees prevailing wages and/or there are third-party service providers of staffing that are not paying prevailing wages, a decision will have to be made on how to address the new law. The decision for the board will be complicated and different for each building. We are working to get all the information necessary for the board to be able to make a decision.In the meantime, our in-house financial management team is preparing documents that illustrate what impact the adoption of prevailing would have on the 2022 budget. One section is based on maintaining the current wages and losing the benefit of the abatement, while the other is based on implementing the prevailing wage and retaining the abatement. For superintendents or resident managers, our review will also assess if the provision of a rent-free apartment in the building offsets the differential between what the building is already paying this worker and the Comptroller’s wage schedule, thereby precluding the need to increase this worker’s wages. In almost all cases, the rent-free apartment will make up this difference.

To help our managed properties navigate the intricacies of the new prevailing wage law, FirstService Residential hosted a live Q&A with Michael Wolfe, president of property management, Ben Kirschenbaum, vice president and general counsel, and Stephanie Cardello, vice president of compliance.

Click here to watch a full replay of the event.

How will the city verify or enforce the payment of prevailing wages?

Boards are required to certify the payment of prevailing wages with New York City’s Department of Finance. The Annual Certification of Eligibility is due April 15, 2022, and will arrive in the form of an affidavit. The certification will apply for the next tax year beginning July 1, 2022.This does not impact the tax abatement filing deadline of February 15.

There is a chance that the New York State Department of Labor will selectively investigate and verify wage certifications. Future tax abatements may be revoked for filing an inaccurate affidavit and failure to pay the prevailing wage.

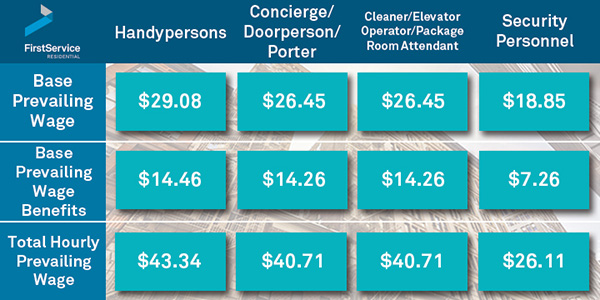

What are the specific prevailing wage rates for building services employees?

Prevailing wage rates and schedules are specified by the New York City Comptroller. These wages are subject to change as 32BJ’s collective bargaining agreement – which is due to expire on April 20, 2022 – is renegotiated.Click here to view the complete prevailing wage schedule for building service employees.

How will paying prevailing wages impact a building’s operating budget?

It is possible that paying your building workers a prevailing wage and benefits will disproportionately increase your building’s payroll expenses. The most common examples are buildings with a high volume of pied-a-terre apartments where the condominium unit owners or cooperative shareholders do not claim their property as a primary residence. For these properties, it is likely that the tax abatements are modest and will not cover the annual payroll increase. Before making any final decisions, FirstService Residential advises boards to consult their building counsel, as it may be wise to forgo the prevailing wage requirement and forfeit the tax abatement.A board’s decision to abstain from paying prevailing wages and forfeit tax abatement eligibility this year will not affect future eligibility should the building decide to pay prevailing wages during the next tax cycle.

Some Important Questions to Consider:

- How many of the building’s owners or shareholders are primary residents?

- What is the payroll increase based on prevailing wages versus anticipated tax abatements?

- How will forgoing prevailing wages impact staff continuity, morale and the quality of staff?

- What is the likelihood the building workers will leave for prevailing wage compensation at another property?

- Is there a risk of 32BJ or other union intervention?

- If there is a large increase in annual payroll, how will the building finance this expense?

Supporting Our Properties with Unmatched Resources

New York City’s web of local laws and regulations is increasingly complex, often requiring expertise that falls outside the purview of a property manager. At FirstService Residential, our property managers have the support of an in-house network of subject matter experts and third-party consultants who are regarded as the industry’s brightest leaders.Additional In-House Experts Include:

- Budget Preparation and Implementation Drawing on decades of experience, our financial experts continuously monitor shifting market trends and proactively identify solutions to protect your most valued asset. We offer personalized roadmaps for the continued success of your property, especially in times of market volatility and crisis, and help develop effective budgets that are supported by timely, comprehensive monthly reports with forecasts of future cash flow, expense tracking and more.

- Local Law Compliance Our dedicated Compliance Department proactively resolves complaints and violations, coordinates permit and licensure renewals and tracks the status of mandated inspections on a daily basis. This includes new and future regulations dictating prevailing wages and tax abatements.

- Tax Certiorari and Protest Services Our clients have access to the experts at Goldstein Weprin Finkel Goldstein, a premier tax certiorari firm. This partnership has enabled our clients to save millions of dollars on real estate tax assessments, as well as the legal fees associated with tax protests.

- Education Programs for Property Managers

To keep our property managers at the forefront of our industry, we regularly host educational sessions led by in-house and local experts on a range of topics that impact the fiscal health of our managed buildings and our boards. Our ongoing training programs are designed to share best practices that enhance day-to-day building operations, ensure compliance with local laws, and consistently deliver the highest level of service.